Polymarket Isn’t Predicting the Future. It’s Liquidating Uncertainty.

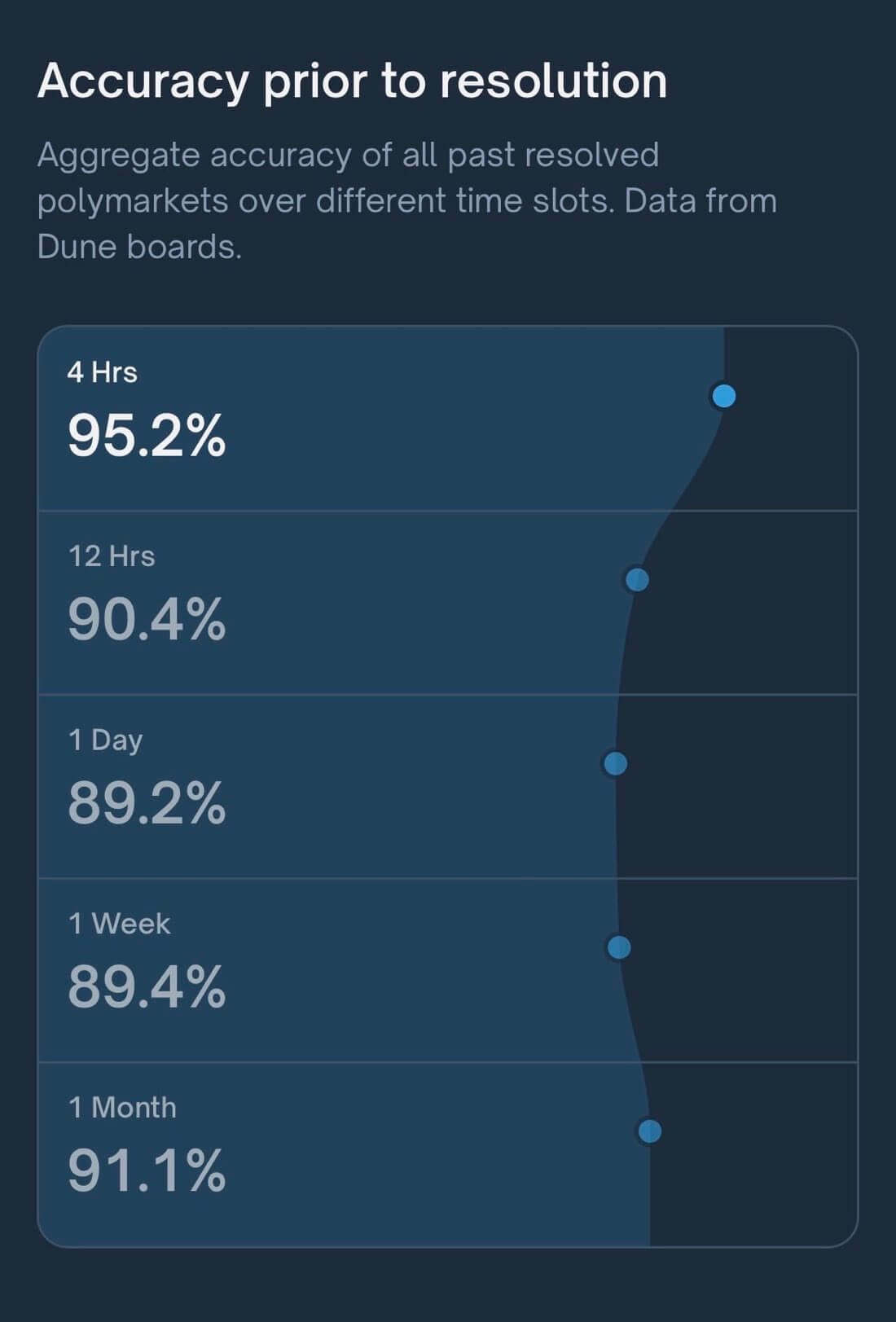

Polymarket hit 95.2% accuracy in the last four hours. Not over a week. Not over cherry-picked markets. Four hours. Across all resolved prediction markets.

"World record," tweeted Atlantislq. "No media in history ever hit that accuracy. 91.1% accuracy over a month, do you realize how crazy that is? We're literally predicting the future."

He's not wrong. Traditional polling has hovered around 60-70% accuracy for decades. Nate Silver's FiveThirtyEight, considered the gold standard of election forecasting, topped out around 75-80% in good years. Polymarket is now consistently maintaining accuracy rates above 90% across timeframes from four hours to one month, with 95.2% at the four-hour mark representing something closer to precognition than prediction.

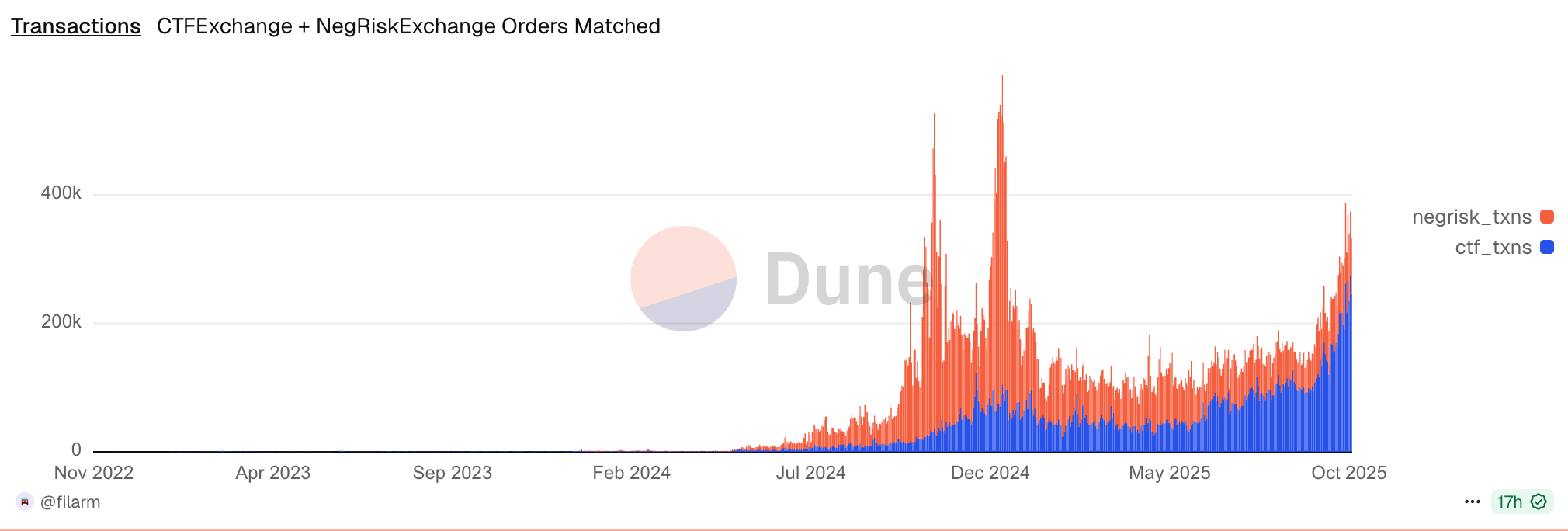

You might think this is theoretical, however the numbers prove it. Transaction volume on Polymarket has exploded from essentially zero in early 2023 to peaks exceeding 400,000 daily transactions in late 2024. The spike during the US election period was dramatic, but what's more interesting is what happened after: the platform didn't collapse back to pre-election baseline. It stabilized at roughly 3-4x pre-election levels.

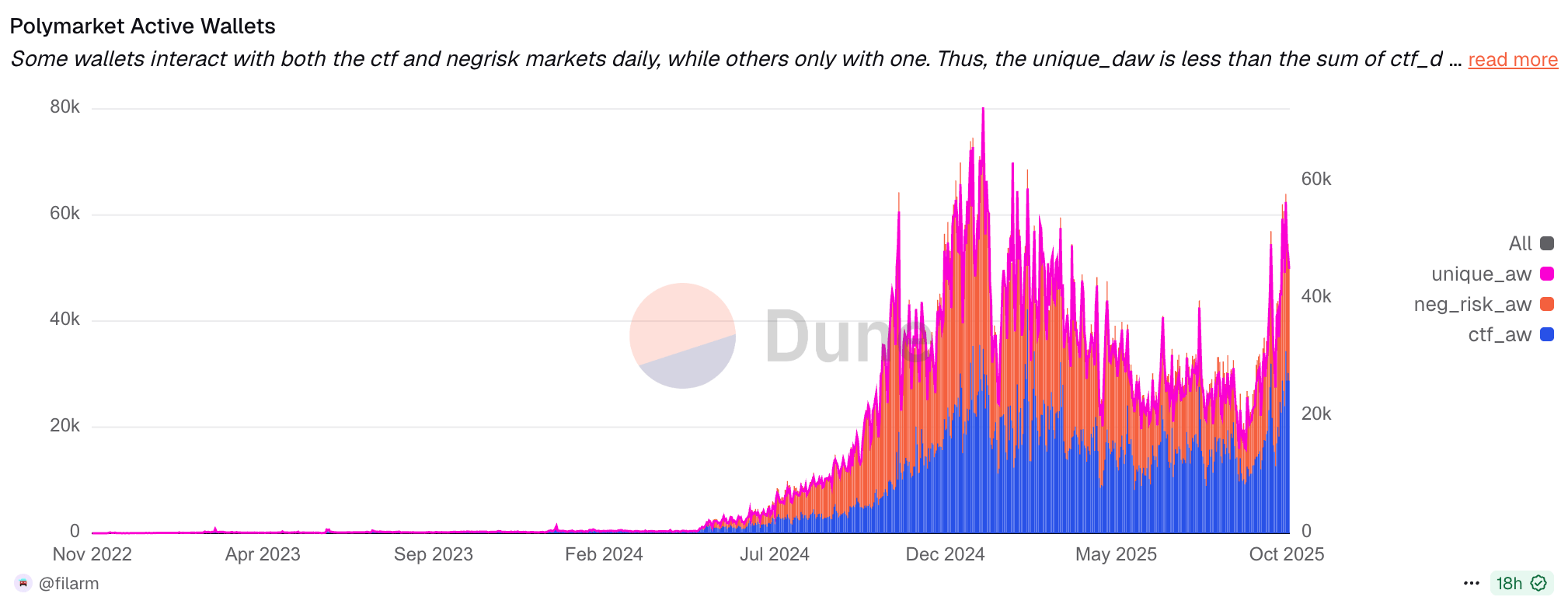

Active wallets tell the same story. Peak activity hit 80,000 daily active wallets during the election, but the sustained growth curve suggests this isn't a one-time event. Are we watching the formation of a new information infrastructure?

The distinction matters, though I'm sure someone in the comments is already typing "cope, it's literally just gambling" with Cheeto dust on their keyboard. Prediction markets aren't betting. They're information aggregation mechanisms that happen to use money as the forcing function for honesty. When you make people put capital behind their beliefs, bullshit evaporates. What's left is signal.

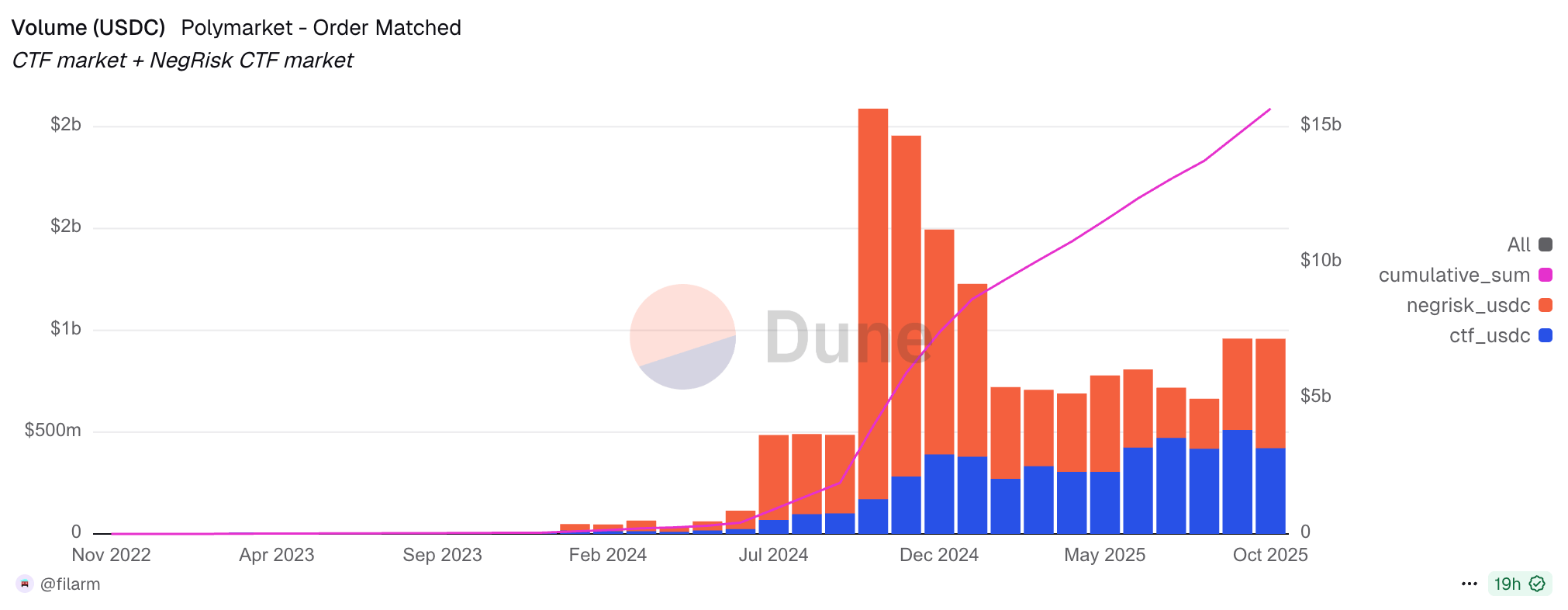

The volume data reveals something fascinating about market maturation. Calculating total volume requires combining CTFExchange and NegRiskExchange, the two different market types Polymarket uses. CTFExchange handles simple binary markets with two possible outcomes. NegRiskExchange manages markets with multiple binary questions where exactly one resolves to YES while all others resolve to NO.

We only count OrdersMatched, not OrderFilled, because OrderFilled includes partial amounts filled by operators that would inflate the numbers. The real volume tells the story: cumulative matched orders have crossed $15 billion, with monthly volumes that spiked to over $2 billion during the election and have now stabilized around $500-700 million monthly.

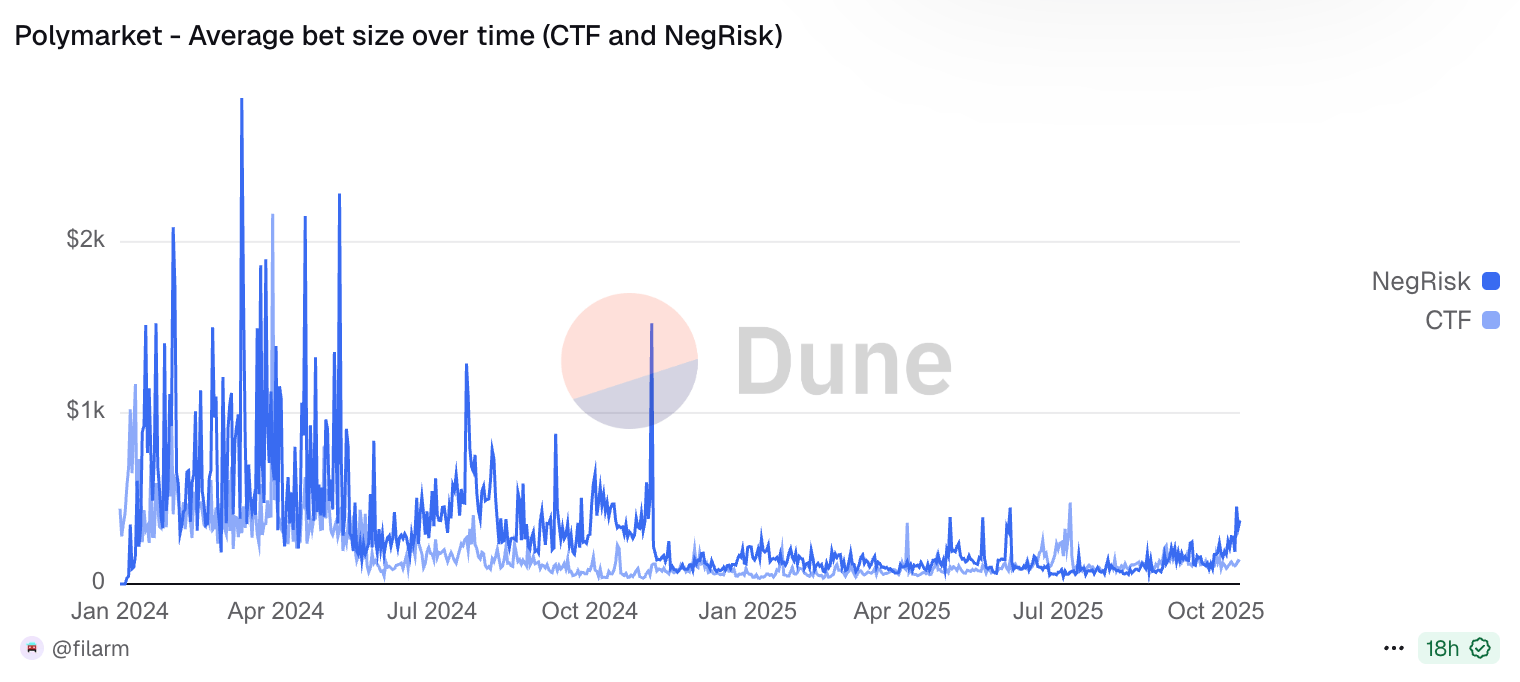

Average bet size has been steadily decreasing for CTF markets while remaining volatile for NegRisk markets. This suggests platform democratization. Early adopters were crypto-native whales making large bets. Now it's regular people making smaller, more frequent predictions across diverse topics.

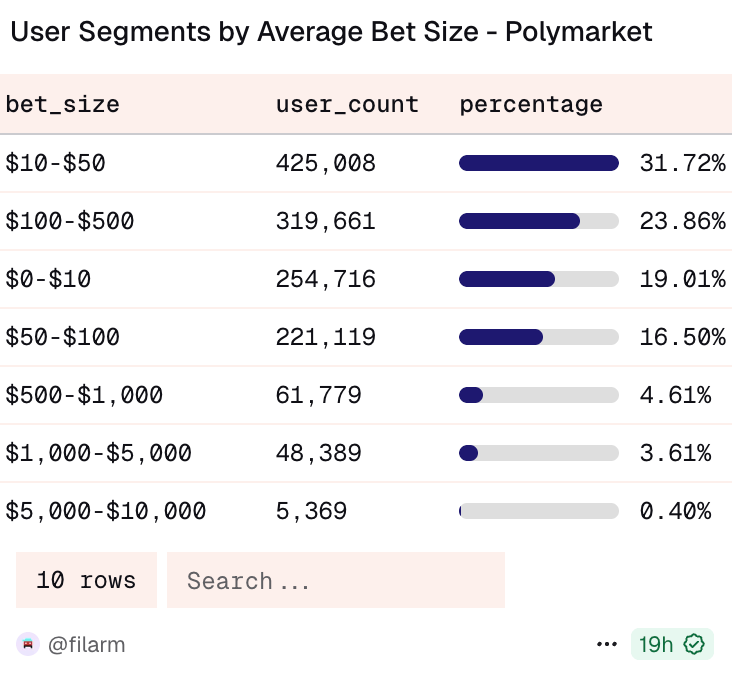

The user segmentation confirms this. 31.72% of users bet between $10-$50. Another 23.86% bet $100-$500. Only 0.40% bet $5,000-$10,000. This looks like mass adoption to me.

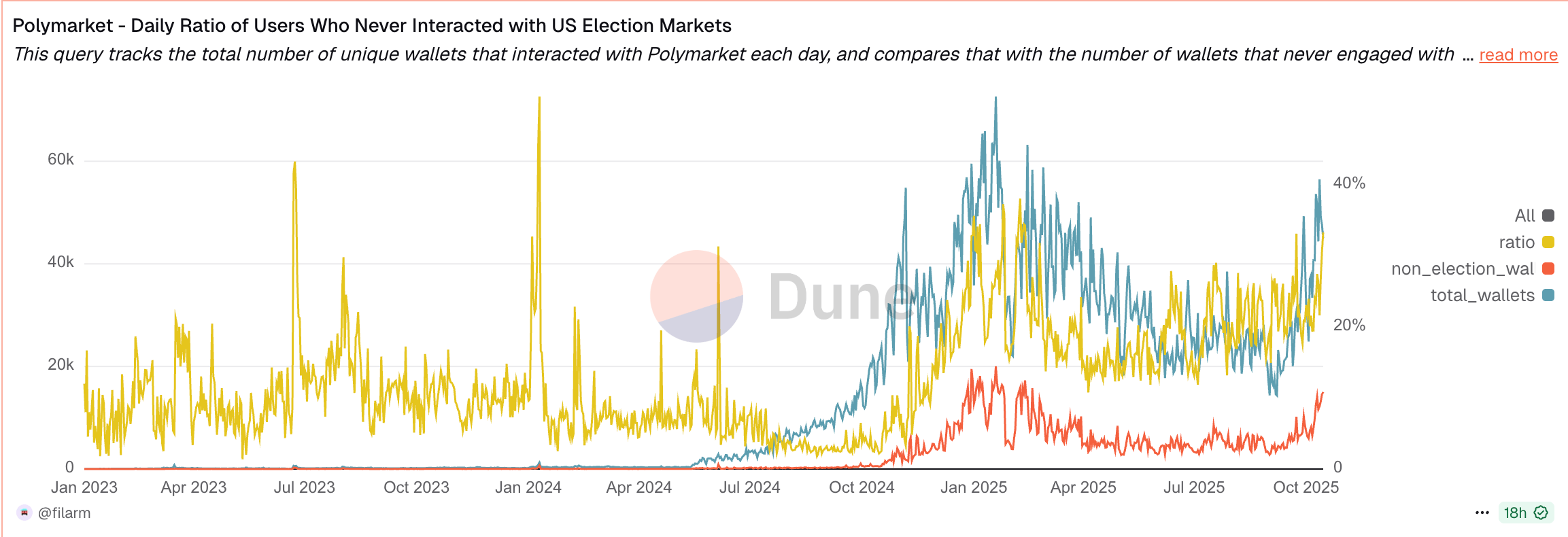

Here's where it gets interesting: most Polymarket activity wasn't election-related. The daily ratio of users who never interacted with US election markets hovered around 20-40% throughout 2024. That means 20-40% of daily active users were betting on sports, entertainment, economics, and niche questions that have nothing to do with politics.

The election was the catalyst, not the product. What Polymarket built is infrastructure for pricing uncertainty across any domain.

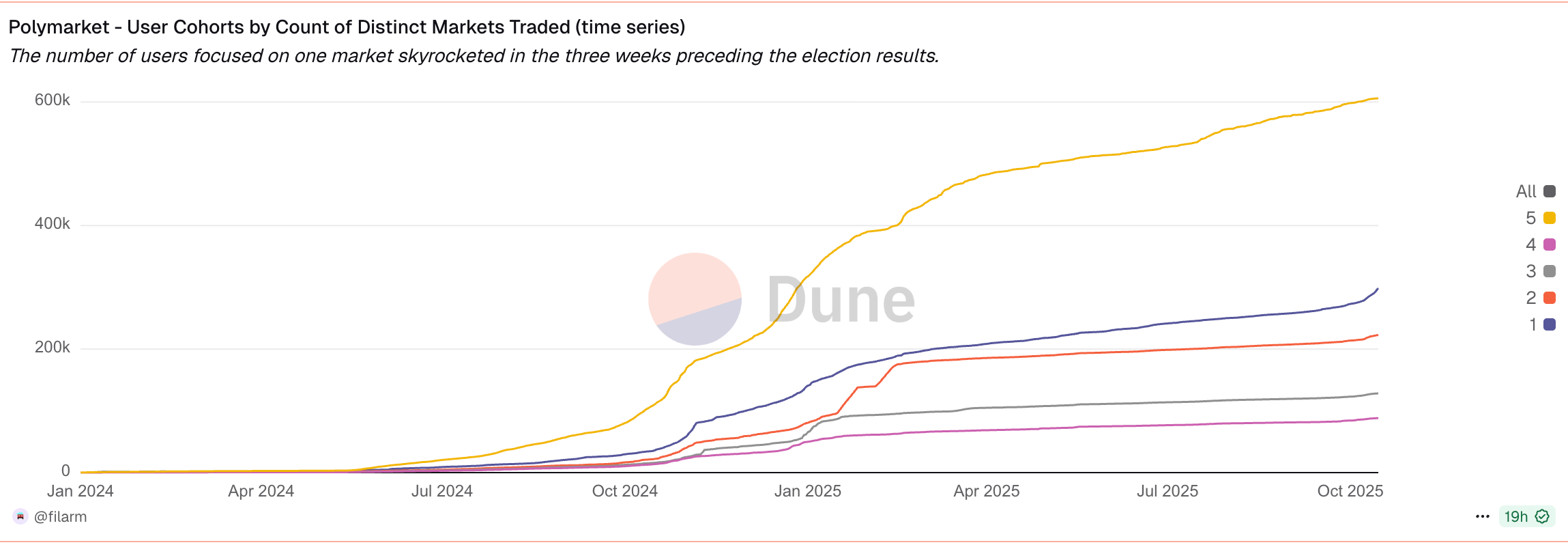

User behavior shows sticky engagement. The number of users focused on single markets skyrocketed in the three weeks before election results, which makes sense. But users trading across five or more markets grew consistently throughout 2024 and continue growing post-election. People aren't leaving. They're diversifying into other prediction topics.

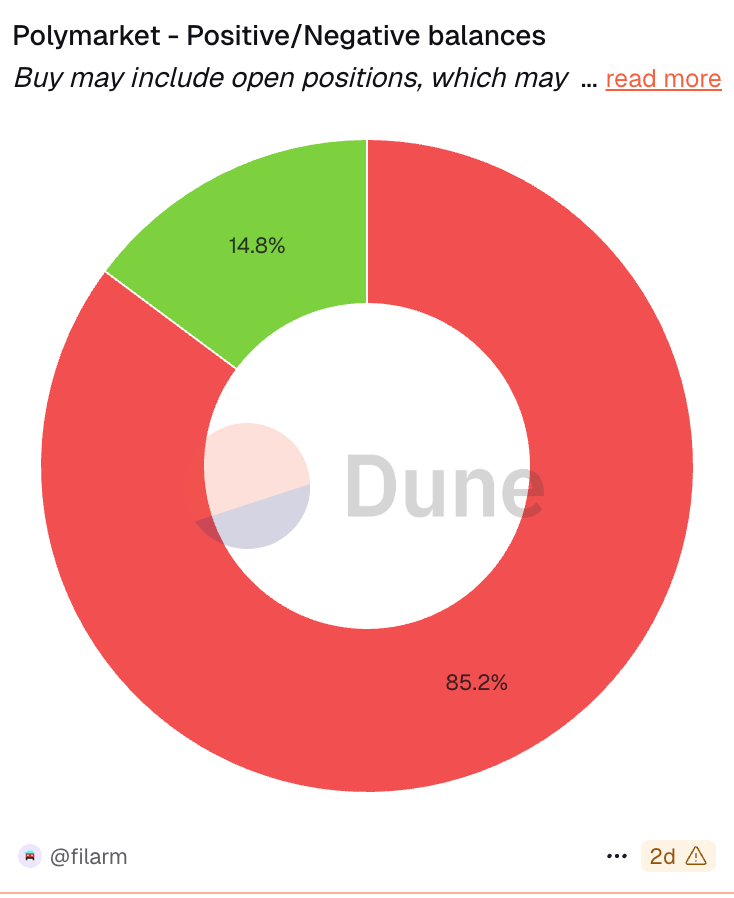

Now for the uncomfortable truth: 85.2% of Polymarket users are currently in negative balance. Only 14.8% are positive. That's 1,146,902 wallets underwater versus 198,788 profitable.

This sounds damning until you understand what it actually means. These figures only capture realized profit and loss, meaning users who have either sold their conditional tokens (shares in a bet) or claimed rewards when markets resolved. Money bet on unresolved markets appears as red (open interest) because it's not liquid. But most could turn profitable when those markets resolve.

The house money effect is also at play here. This is a theory explaining why investors take greater risks when reinvesting profits than when investing savings. Election winners are now rolling winnings into smaller, longer-term markets. The 85.2% negative balance might simply reflect that most users are holding open positions in future-dated markets.

Traditional sports betting sees only about 3% of bettors profitable by year-end. Polymarket's 14.8% profitable users is nearly 5x better. That gap represents the difference between betting against a house edge and trading on an information market where skill compounds.

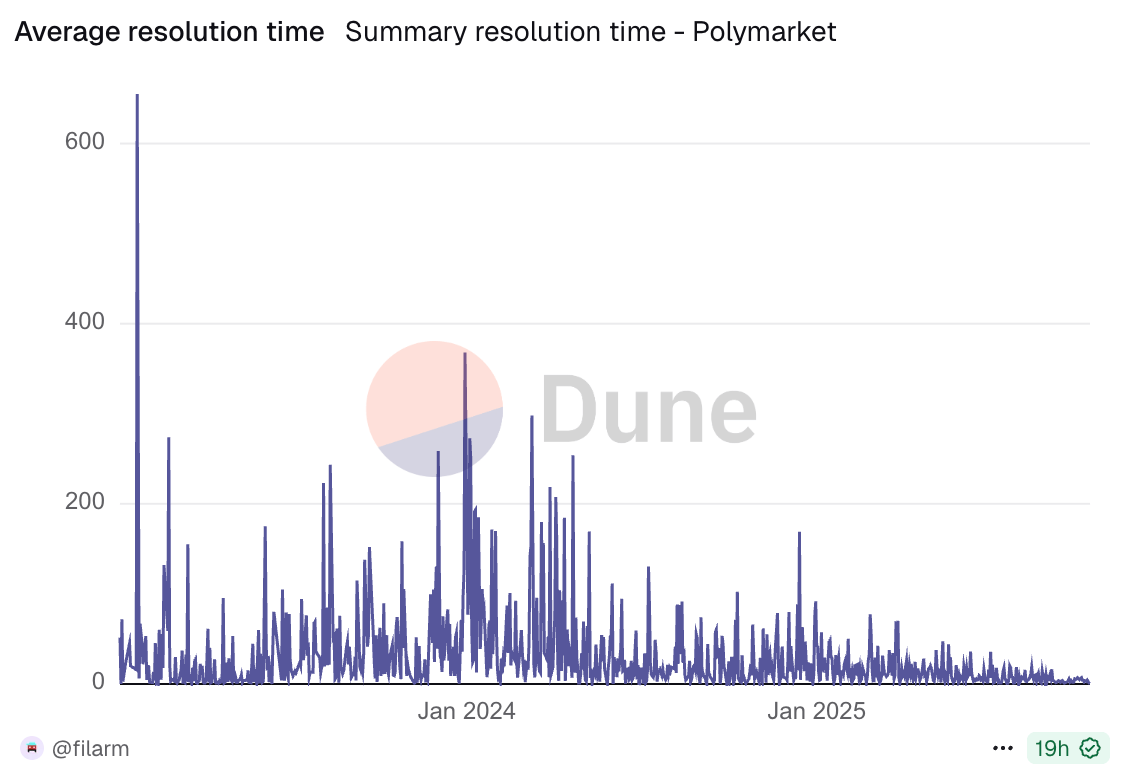

Resolution times have been dropping dramatically. Average resolution time is now 17 days, median is 4 days, with a standard deviation of 38 days. This suggests two things: more short-term markets are being created as users look for frequent opportunities to speculate, and the infrastructure for resolving markets is getting faster and more efficient.

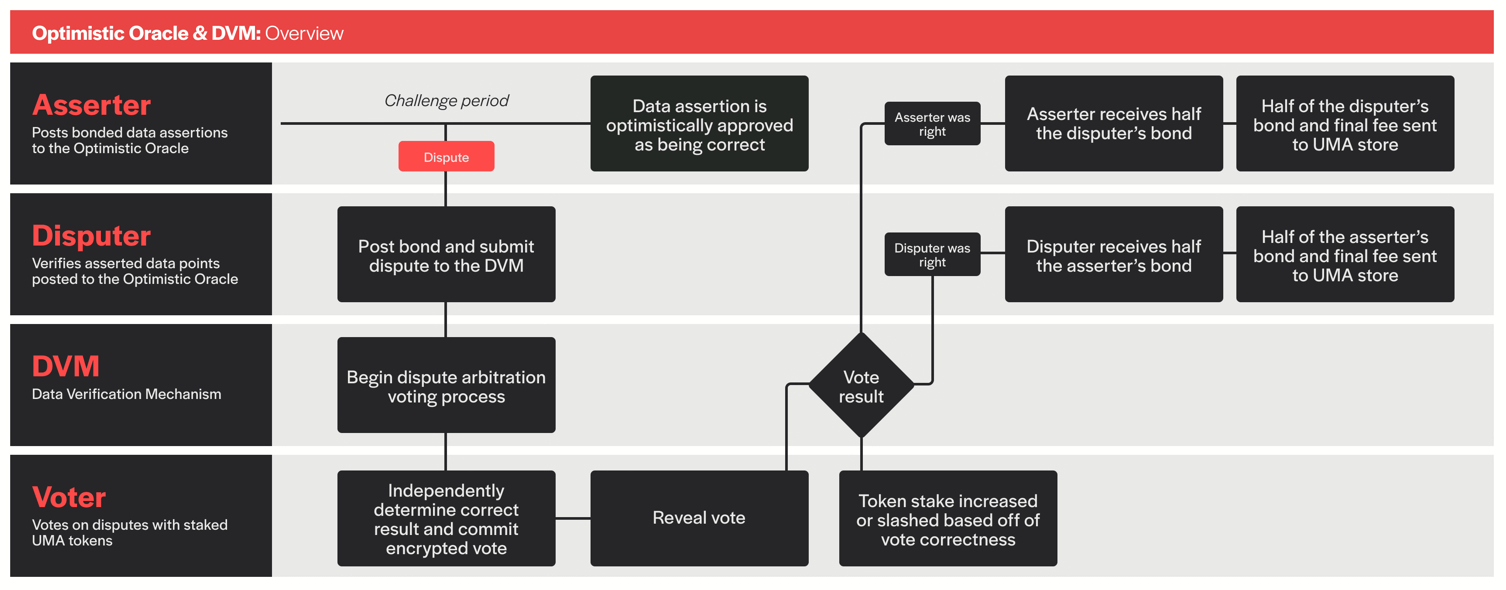

This brings us to the oracle problem. How does Polymarket know what actually happened?

Polymarket uses UMA's Optimistic Oracle, which is about as clever as oracle design gets. Here's how it works:

When a market needs resolution, an Asserter posts a bonded assertion about the state of the world. They're putting their own money on the line claiming "this is what happened." That assertion sits in a liveness period where anyone can dispute it.

If nobody disputes within the liveness period (usually 2 hours to 2 days depending on the market), the assertion is treated as correct and the market resolves. The Asserter gets their bond back plus a reward.

If someone disputes the assertion, it escalates to UMA's Data Verification Mechanism (DVM), where UMA token holders vote on the correct outcome. The DVM vote concludes after 48-96 hours. Voters reference off-chain price feeds and methodologies defined in the market's UMIP (UMA Improvement Proposal) to determine ground truth.

The economic guarantees are elegant: it costs more to corrupt the oracle (acquire 51%+ of UMA tokens) than anyone could profit from corrupting it (stealing funds from contracts). The game theory makes honesty the rational choice.

For Polymarket specifically, markets use the UMA CTF Adapter, which acts as the bridge between UMA's Optimistic Oracle and Conditional Tokens Framework that Polymarket markets are built on. When a market resolves, the adapter fetches resolution data from UMA and relays it to both CTFExchange and NegRiskExchange markets.

There's also an emergency resolution mechanism where admins can flag a market for emergency resolution with a 2-day delay, but this is rarely used and primarily exists for edge cases where oracle data is corrupted or unavailable.

The number of questions initialized through the UMA adapter has grown steadily throughout 2024, while average resolution time has dropped considerably. This proves the infrastructure is maturing.

The implications extend far beyond election forecasting. What Polymarket has demonstrated is that markets are better than media at determining truth. Not sometimes. Always.

You are thinking it right now aren't you? Shayne is a fucking genius!

Traditional media optimizes for engagement, not accuracy. Journalists have no skin in the game. Prediction market participants do. Every wrong prediction costs them money. Every correct prediction makes them money. The incentive structure forces accuracy in ways that news organizations structurally cannot achieve.

This is why Polymarket called the election correctly while most mainstream polling was hedging bets. The New York Times gave Trump roughly 50-50 odds on election day. Polymarket gave him 60-40 and was climbing. People with actual money on the line saw what pundits with Twitter followers missed.

The accuracy advantage isn't marginal. It's structural. And it applies to any question where ground truth eventually becomes knowable.

Want to know if Apple will hit $200 per share by year-end? There's a market for that. Want to know if Russia and Ukraine will have a ceasefire by March? There's a market for that. Want to know which movie will win Best Picture? There's a market for that.

The prediction market supercycle isn't about gambling. It's about replacing speculation with information aggregation. It's about making the future legible in real-time rather than retrospectively.

When Polymarket hit 91.1% accuracy over a month, it wasn't luck. It was proof of concept. When it hit 95.2% over four hours, it was proof of scale. The question now isn't whether prediction markets work. It's how fast the rest of the information economy realizes traditional forecasting is obsolete.

ICE just invested $2 billion in Polymarket at a $9 billion valuation. The New York Stock Exchange's parent company isn't betting on a fad. They're betting on infrastructure that makes uncertainty tradable and truth verifiable.

We're not predicting the future anymore. We're watching it price itself in real-time, with accuracy that would have seemed impossible five years ago. The future sees itself now, and it's 95.2% correct.

The prediction market supercycle is indeed just beginning.

All data analysis and visualizations in this article come from @filarm on Dune Analytics. If you want to track Polymarket's metrics in real-time or dive deeper into the on-chain data that powers these insights, check out their dashboards at dune.com/filarm and make sure you follow fil on X.

They're doing the work that makes understanding this space actually possible.